Have Any Query Feel Free Contact

Quick Contact

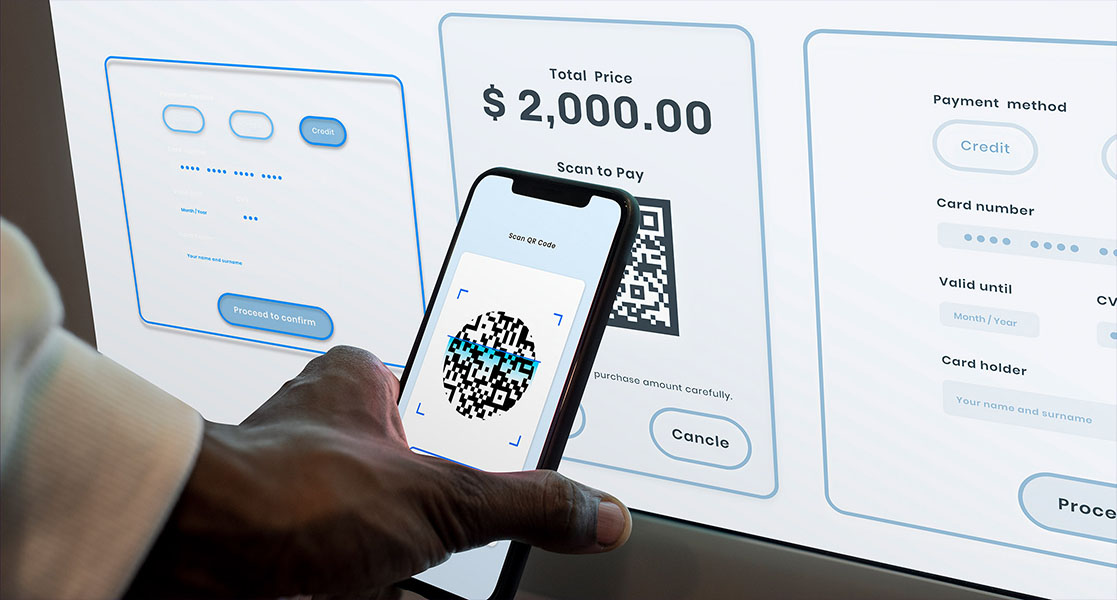

Payment technologies

Solve your toughest payment challenges

Our team understands the payment ecosystem. We are renowned for tackling business challenges. With MPS, you get a partner to help resolve complex problems-and provides access to the most innovative technologies.

With MPS, you get a partner to help resolve complex problems-and provides access to the most innovative technologies. We partner with the leading software solutions in the market. Leverage our extensive knowledge, expertise and experience in implementing the best of breed solutions to meet your goals and objectives.

4 main steps for a successful payments strategy roadmap

Evaluate your position in the market.

Questions will identify key environmental factors like the size of the institution and the number of customers and branches.

Take stock of your existing offerings and identify gaps.

After this initial appraisal, we will walk you through a series of questions that ask about your digital payment products and plan near-term changes.

Assess your current and future customer needs.

Once current offerings are evaluated, we will share more about your clients and target audiences

Create a realistic roadmap to take you into the future.

future. Based on this input, the tool will offer a model and identify where you fall on the digital payment’s development spectrum. A corresponding report will offer recommendations on the next steps as you continue to build your bank’s digital payments infrastructure

Our benefits

Support Management

Digital Marketing

Your payments strategy roadmap redefines payments across your bank’s products, processes and platforms.

Payments are the heart of your business. Digital makes them possible in new ways. Partner with our team to simplify and secure your bank’s payments processes and platforms.

- Core platform assessment and rationalization

- Platform re-architecture (microservices/open API)

- Enhancement and redesign of payment instruments such as checks, lockbox, cash processing, electronic payments and wires

- End-to-end payment hubs, including core modernization, vendor comparison and implementations

- API catalog and microservices design accelerator

- Enterprise payments strategy and design

Develop a digital strategy

Our comprehensive strategy enables retail and commercial institutions to implement a payment platform for domestic, international and cross boarder payments. With our global footprints and payments expert team we will help you to grow business vertically.

Key offerings include:

- Business IT Assessment and Transformation Roadmap

- Portfolio Rationalization

- Domain lead delivery assessment framework

- Vendor and Fintech partner assessment

- Payments rails adoption

- Payments Strategy Design

- Market Research

- Global Payments rails adoption strategy ISO20022, RTP, FEDNOW, Faster Payments, NACHA, ACH, SEPA, Mass payments, Different countries payments rails

Payment strategy

Payments are the heart of your business. Digital makes them possible in new ways. Partner with our team to simplify and secure your bank’s payments processes and platforms.

- International Market Expansion Strategy. In depth market, competitors, customer insights and new market entry opportunities, International Expansion, Merger and Acquisition.

- Payment Modernization & Optimization Digital & Open Banking Transformation Strategy, Vendor; Fintech partnership

- Global Payments rails adoption strategy ISO20022, RTP, FEDNOW, Faster Payments, NACHA, ACH, SEPA, Mass payments, Different countries payments rails

Payments Modernization

- Payment Architecture Optimization

- Modern Payment platform and Capabilities MT to MX/ISO20022 Integration,

- Payments Hubs, Real Time payments, Commercial cards.

- Transformation of legacy applications to current world technology stacks

- Digital channel adoption and integration

Development & implementation

- System analysis, design, configuration and implementation of the leading Payment software solutions

- Software Development

- DevOps

- Agile Transformation

- API & Microservices

- Cloud readiness

- Mobile product development and integration with 3 rd Party products.

Management

- Enterprise payments strategy and design

- Core platform assessment and rationalization

- API catalog and microservices design accelerator

- End-to-end payment hubs, including core modernization, vendor comparison and implementations

- Enhancement and redesign of payment instruments such as checks, lockbox, cash processing, electronic payments and wires

FAQ

What makes your payment solutions different from others in the market?

We specialize in tackling complex payment challenges with a deep understanding of the payment ecosystem and the leading software solutions in the marketplace. Our solutions offer a comprehensive strategy for both domestic and international payments, designed to simplify and secure your payment processes. We partner with the most advanced technology providers and have the most experience in successfully implementing these systems. We provide access to cutting-edge technologies like microservices, open APIs, and end-to-end payment hubs, ensuring your business stays ahead of the curve.

How can your team help improve my bank's payment processes?

Our team works closely with you to assess, rationalize, and modernize your payment platforms. We provide expert guidance on core platform optimization, vendor comparison, and re-architecting systems for improved efficiency. From electronic payments to cash processing, we ensure your bank’s payment instruments are streamlined, secure, and adaptable to future growth.

What is the process for implementing a digital payment strategy for my business?

Our approach starts with thorough market research and business IT assessment, followed by designing a tailored payment strategy that aligns with your goals. We assist in adopting the right payment rails and partner with fintech vendors to ensure seamless integration. Our team also guides you through every phase, from portfolio rationalization to implementing scalable solutions for cross-border payments.

How do you ensure the security of payments across different platforms?

Security is a top priority in our payment solutions. We work with advanced technologies and follow industry best practices to ensure the highest level of security for both your retail and commercial transactions. From encryption to secure APIs, we take all necessary measures to protect your business and customer data across all platforms and payment instruments.

Can you help my business transition to a modern payment system if we're still using legacy platforms?

Yes, we specialize in re-architecting and modernizing legacy payment systems. Our end-to-end solutions include core platform modernization, integration with microservices, and adopting open APIs for enhanced flexibility. We ensure a smooth transition to a more agile and scalable system, enabling your business to grow without the constraints of outdated technologies.